Contents

Conforming Loan Interest Rates rates for fha loans conventional fha loans FHA loans allow you to get a mortgage and buy a home sooner, but they come at a cost. If you can qualify for a conventional mortgage instead, you may save thousands over the life of your loan.The decrease in interest rates on all 30-year loans was driven in large part by month-over-month interest changes for 30-year conventional loans, which on average decreased from 4.81% to 4.7%, and VA.Current Conforming Loan Limits. On November 27, 2018 the Federal Housing Finance Agency (FHFA) raised the 2019 conforming loan limit on single family homes from $453,100 to $484,350 – an increase of $31,250 or 6.9%. That rate is the baseline limit for areas of the country where homes are fairly affordable.

This includes FHA’s definition of a “surviving non-borrowing spouse. the NBS cannot withdraw unused funds from the remaining loan balance even as mortgage insurance premiums and service fees will.

A federal housing administration (fha) loan is a mortgage insured by the FHA. By insuring the loan, the FHA offsets the risk associated with lending to low- to moderate-income borrowers. Federal Housing administration mortgage volume could get a boost from regulatory reform, because loans insured by government agencies are.

A federal housing administration (fha) loan is a mortgage insured by the FHA. By insuring the loan, the FHA offsets the risk associated with lending to low- to moderate-income borrowers. Federal Housing administration mortgage volume could get a boost from regulatory reform, because loans insured by government agencies are.

The August panel decision upholding the $298 million judgment “radically changed Fifth Circuit law and puts the Fifth Circuit’s definition. thousands of insurance claims from unregistered mortgage.

Mortgage Insurance is Required for an FHA Loan. upfront monthly premium payment, which means.

The Federal Housing Administration, generally known as "FHA", provides mortgage insurance on loans made by FHA-approved lenders throughout the United States and its territories. FHA insures mortgages on single family homes, multifamily properties, residential care facilities, and hospitals.

An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan which is provided by an FHA-approved lender. FHA insured loans are a type of federal assistance and have historically allowed lower income Americans to borrow money for the purchase of a home that they would not otherwise be able to afford.

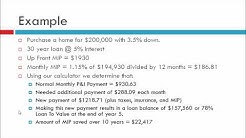

FHA loans are insured through a combination of an upfront and annual mutual mortgage insurance (MMI) premiums. The UFMIP is a lump sum ranging from 1 – 2.25% of loan value (depending on LTV and duration), paid by the borrower either in cash at closing or financed via the loan.

An FHA 203(k) loan is a type of government-insured mortgage that allows the borrower to take out one loan for two purposes – home purchase and home renovation. An FHA 203(k) loan is wrapped around.

A VA loan is a mortgage loan available through a program established by the United States Department of Veterans Affairs. VA loans assist service members, veterans and eligible surviving spouses to.

Pmi Mortgage Rates For many home buyers, one of the biggest challenges to enjoying homeownership is the downpayment. Thanks to private mortgage insurance, or PMI, U.S. home buyers have a number of low, or even no.

The definition of fha title 1 loan “improvements” is fairly broad. and $7,500 for a manufactured home without a foundation An FHA-insured product known as the 203(k) loan is often used to fund.