Contents

However, this doesn’t influence our evaluations. Our opinions are our own. For years, the Federal Housing Administration was the king of the low-down-payment mortgage mountain. Now, Fannie Mae and.

However, there are exceptions; some lenders will let you borrow against your home equity at higher loan-to-value ratios. The calculator will give your current loan-to-value ratio – the percentage of.

Calculate how much house you can afford with our home affordability calculator. Factor in income, taxes and more to better understand your ideal loan amount.

Calculate how much house you can afford with our home affordability calculator. Factor in income, taxes and more to better understand your ideal loan amount.

Texas First Time Home Buyers Can I Afford It Calculator Have you found yourself wondering "how much car can I afford?" What many people think about when they ask this question is what type of monthly payment they can comfortably afford. Our car affordability calculator tells you exactly how much money you can afford to spend in total on your next vehicle purchase.Texas First Time home buyers resource center. 1,597 likes 3 talking about this. The FTHB Resource Center of Texas helps borrowers navigate available.

Fair Housing Act. How Much Can I afford? fha mortgage Calculator. Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford before you make an offer on the home you want to purchase.

The LendingTree home affordability calculator allows you to analyze multiple scenarios and mortgage types to find out how much house you can afford.

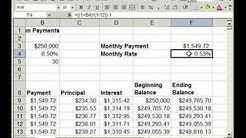

Check out the web’s best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner’s insurance, HOA fees, current loan rates & more. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules.

Use this calculator to better understand how much you can afford to pay for a house and what the monthly payment will be with a VA Home Loan.

Use our home affordability calculator to figure out how much house you can afford. Use our home affordability calculator to figure out how much house you can afford.. student loan and car.

How Much Can I Afford In A House If you’re thinking now’s the time to pull the trigger on a home purchase, you’ll be jumping in at a time when housing prices are rising, and in some markets, you may find yourself competing with other.

Desired Loan Amount: Preferred Repayment Period: Loan Tenure (monthly) 30 years 29 years 28 years 27 years 26 years 25 years 24 years 23 years 22 years 21 years 20 years 19 years 18 years 17 years 16 years 15 years 14 years 13 years 12 years 11 years 10 years 9 years 8 years 7 years 6 years 5 years 4 years 3 years 2 years 1 year

Axis Car Loan. one can afford. That would play a big role in selecting the car model and also deciding on the loan amount.

How Much For A Mortgage Can I Afford Budget For House Based On Income Low Income Apartments in San Diego, CA – There are 166 low income housing apartment complexes which contain 16,580 affordable apartments for rent in San Diego. Many of these rental apartments are income based housing with 5,736 apartments that set rent based on your income. In San Diego, hud housing programs support 4,732 rental assistance apartments through programs like project-based section 8.Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2000.

See how much house you can afford with our home affordability calculator. explore mortgage options and discover how much your monthly payment would be.

Mortgage Affordability Calculator How much can you borrow? This tool will help you estimate how much you can afford to borrow to buy a home. We’ll work it out by looking at your income and your outgoings.